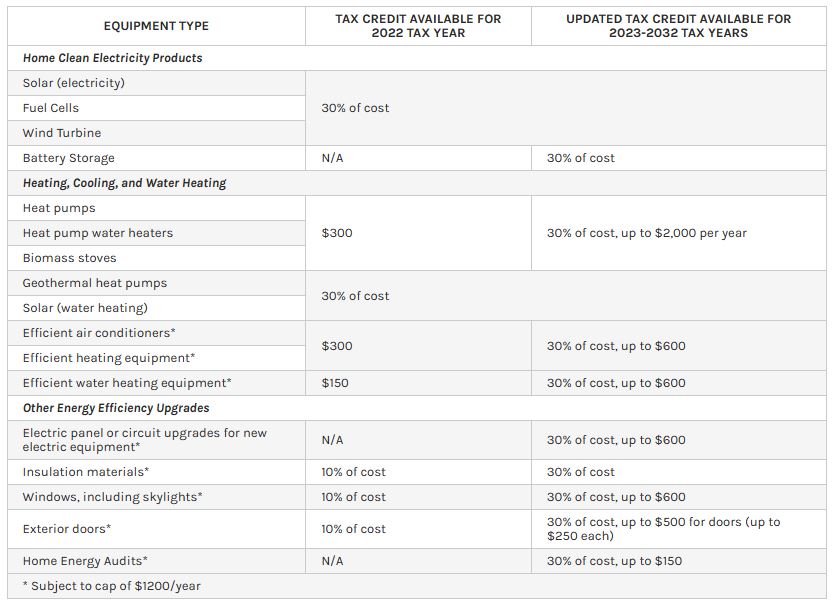

Homeowners, including renters for certain expenditures, who purchase energy and other efficient appliances and products might be eligible for a clean energy tax break.

To get the tax credits you need to Fill out IRS Form 5695, following IRS instructions, and include it when filing your tax return. Include any relevant product receipts.

Consumers can claim the same or varying credits year after year with new products purchased, but some credits have an annual limit. See the table below.

More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals, building contractors, and others at IRS releases frequently asked questions about energy efficient home improvements and residential clean energy property credits | Internal Revenue Service. See: https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions-about-energy-efficient-home-improvements-and-residential-clean-energy-property-credits

Disclaimer: This article does not constitute professional tax advice or other professional financial guidance and the information may be subject to change. It should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.